Citation

Chang, T., & Schoar, A. (2007). Judge-specific differences in Chapter 11 and firm outcomes. The Journal of Law and Economics, 50(4), 703–730. https://web.mit.edu/aschoar/www/ChangSchoar_Judges52007.pdf

Research Question

How do individual bankruptcy judges’ systematic pro-debtor or pro-creditor tendencies influence Chapter 11 case outcomes and firms’ post-bankruptcy performance?

Key Takeaways

Random assignment means the identity of the bankruptcy judge is an exogenous shock that materially alters Chapter 11 outcomes; Judges exhibit stable, one-dimensional pro-debtor versus pro-creditor tendencies that shape a wide range of rulings; Pro-debtor judges increase shutdown and refiling rates and are linked to weaker post-emergence growth and credit quality; Pro-creditor judges resolve cases faster and are associated with better going-concern outcomes for surviving firms; Adverse effects of pro-debtor rulings are most pronounced for larger and incorporated firms, consistent with managerial agency problems; Practitioners should treat judge-specific tendencies as central inputs into filing strategy, motion practice, and negotiation posture.

Dataset Description

The authors assemble a case-level dataset of roughly 4,800–4,900 Chapter 11 filings by mostly private firms across six U.S. federal bankruptcy districts (Arizona; Central District of California divisions LA, ND, RS, SA, SV; Delaware; Northern District of Georgia; New Jersey) over approximately 1989–2004. Case dockets and judicial rulings on about 18 key motions (e.g., automatic stay, cash collateral, exclusivity extensions, asset sales, conversions, dismissals) are collected from PACER, algorithmically parsed, and hand-checked. These data are merged with firm characteristics from Dun & Bradstreet (sales, employment, legal form, credit ratings) and the NETS panel (sales, employment, PAYDEX credit scores) to track shutdown, refiling, and multi-year post-bankruptcy operating and credit outcomes.

Methodology

statistical/quantitative

Key Findings

Within bankruptcy districts, Chapter 11 cases are effectively randomly assigned to judges, creating quasi-experimental variation in the identity of the presiding judge. Exploiting this randomization, the paper documents large and persistent judge-specific differences in how key motions are decided: some judges consistently grant debtor-favorable requests (e.g., extending exclusivity, continued use of cash collateral, maintaining the automatic stay), while others systematically favor creditor positions (e.g., lifting the stay, converting to Chapter 7, dismissing weak cases). These tendencies are highly correlated across motions and can be summarized by a one-dimensional pro-debtor-versus-pro-creditor index. Instrumenting for firms’ legal environment with judge fixed effects, the authors find that assignment to a more pro-debtor judge is associated with higher probabilities of firm shutdown and refiling and with weaker post-emergence performance, as measured by slower sales growth and poorer credit ratings. Conversely, more pro-creditor judges are associated with faster case resolution and better going-concern outcomes for surviving firms. The negative effects of pro-debtor judges are strongest for larger and incorporated firms, consistent with an agency-governance mechanism in which debtor-friendly rulings empower entrenched managers to delay or dilute necessary restructuring. Overall, the results suggest that, at the margin, U.S. Chapter 11 may already be excessively debtor-friendly and that unobserved judicial heterogeneity is a first-order determinant of both case trajectories and real economic performance.

Summary

The paper investigates how much individual bankruptcy judges matter for distressed firms reorganizing under Chapter 11. Within each federal bankruptcy district, cases are effectively randomly assigned to judges, and the authors verify empirically that firms’ observable characteristics, size, industry, credit quality, incorporation status, and timing are balanced across judges. This quasi-random assignment allows them to treat the identity of the judge as an exogenous shock to the legal environment a debtor faces, rather than as an outcome of forum shopping or strategic selection.

Using detailed docket data from PACER, the authors build judge-level profiles based on roughly 18 recurring motions that structure Chapter 11 practice, such as extensions of exclusivity, permission to use cash collateral, approval of asset sales, stays, conversions, and dismissals. They find large and systematic heterogeneity: some judges repeatedly favor debtor positions, others systematically favor creditors. These patterns are not motion-specific noise; principal component analysis reveals a strong one-dimensional factor that captures a judge’s overall pro-debtor versus pro-creditor orientation. This index is stable over time and robust to alternative specifications, indicating genuine, persistent judicial style rather than idiosyncratic case mixes.

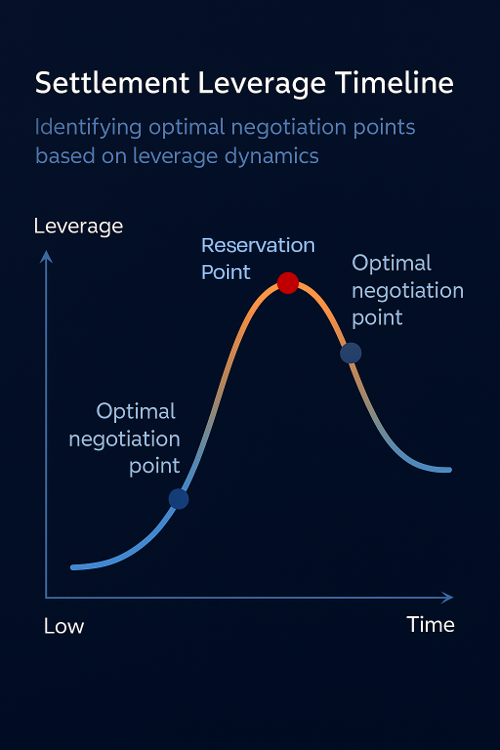

Linking this judicial index to firm outcomes yields results that counter much conventional wisdom about reorganization. If debtor protection were unambiguously value-enhancing, one would expect pro-debtor judges to be associated with more successful reorganizations. Instead, firms randomly assigned to more pro-debtor judges are more likely to shut down or refile for bankruptcy and, conditional on surviving, exhibit weaker post-emergence performance measured by sales growth and credit ratings from commercial data sources. Pro-creditor judges, by contrast, are associated with quicker case resolution and better going-concern outcomes. Instrumental-variable estimates using judge fixed effects show that specific debtor-favorable rulings, especially repeated extensions of exclusivity and broad permission to use cash collateral, are linked to higher future refiling probabilities, suggesting that some apparent courtroom victories undermine restructuring discipline.

To explain these patterns, the authors emphasize corporate governance and agency conflicts. In many distressed firms, particularly larger corporations with separation of ownership and control, management’s incentives diverge from those of residual claimants. A more debtor-friendly judge can inadvertently prolong weak cases, sustain inefficient management, or enable the diversion of value from the estate. Consistent with this mechanism, the detrimental effects of pro-debtor judicial styles are concentrated among larger and incorporated firms, where agency frictions are most severe, and are less visible in smaller owner-managed businesses. The findings imply that the marginal Chapter 11 framework may already overweight debtor protection, and that creditor-leaning judges can, in practice, play a value-preserving disciplinary role.

For practitioners and policymakers, the study underscores that judicial heterogeneity is not a second-order detail but a central feature of bankruptcy outcomes. For lawyers and advisors, knowledge of a judge’s historical tendencies should inform venue expectations, motion strategy (e.g., how aggressively to pursue exclusivity extensions or resist conversion), negotiation leverage, and counseling clients on the realistic prospects of true rehabilitation versus eventual shutdown or refiling. For system designers, the results raise questions about the consistency of justice and the desirability of mechanisms that either mitigate or at least make transparent judge-specific styles in corporate reorganization.

How the Study Advances Empirical Understanding of Legal Outcomes

The study finds that Chapter 11 outcomes exhibit structured, repeatable patterns driven by institutional assignment rules and systematic differences in how bankruptcy law is applied, rather than by case-specific randomness. By exploiting random assignment of cases to judges within districts, the analysis shows that consistent pro-debtor or pro-creditor ruling environments are associated with distinct procedural trajectories and downstream firm outcomes, underscoring that legal results emerge from stable features of the decision environment. This quasi-experimental, case-level methodology aligns with Pre/Dicta’s emphasis on empirically grounding assessments of legal outcomes in observed institutional variation and documented outcome regularities as a necessary foundation for sophisticated litigation analysis.