Citation

Bhattacharya, U., Galpin, N., & Haslem, B. (2017). The home court advantage in international corporate litigation. Journal of Law and Economics, 60(3), 405–439. https://www.journals.uchicago.edu/doi/abs/10.1086/519817

Research Question

Do U.S. corporations enjoy a home court advantage over foreign corporations in U.S. federal corporate litigation, and at what stage of the litigation process does any such advantage arise?

Key Takeaways

Foreign corporate defendants experience substantially larger negative abnormal returns at lawsuit filing than comparable U.S. defendants; After controlling for selection into lawsuits, U.S. corporations are significantly more likely to win trials than foreign firms, while dismissal and settlement rates are similar; The foreign-defendant disadvantage is regionally concentrated and particularly strong in some Northeastern and Western federal districts; The home court advantage manifests mainly in judge-decided trials rather than jury trials; Cross-listing via ADRs does not materially reduce either the market penalty or the litigation-outcome gap for foreign firms; Empirical profiling of court, region, and decision-maker materially improves prediction of case value and informs forum and settlement strategy for multinational defendants

Dataset Description

The study uses a PACER-based dataset of U.S. federal civil cases filed between 1995 and 2000 against publicly traded corporations, limited to antitrust, contract, employment, patent infringement, and product liability suits. After excluding prior filings within 270 days and observations with missing stock-return data, the final litigation sample consists of 3,076 lawsuits: 2,361 with U.S. corporate defendants and 715 with foreign corporate defendants. Firm accounting data are drawn from Compustat for U.S. firms and Worldscope for foreign firms; stock returns come from CRSP (U.S.) and Datastream (foreign). The authors also assemble a universe of 43,483 non-sued U.S. firms and 46,376 non-sued foreign firms during the same period to estimate the probability of being sued. ADR status is obtained from the Bank of New York. Litigation outcomes are coded as dismissal, settlement, judge- or jury-trial win or loss, and, where available, damages. Jurisdictionally, the dataset covers U.S. federal district courts nationwide for cases filed 1995–2000, with outcome tracking extending into the early 2000s.

Methodology

statistical/quantitative

Key Findings

Using event-study methods, the authors find that stock markets react negatively to corporate lawsuits filed but penalize foreign defendants significantly more than U.S. defendants, even after controlling for firm size, leverage, profitability, industry, claim type, and year. Median three-day dollar losses are several times larger for foreign firms, and this gap persists after a Heckman-style correction for the non-random probability of being sued using the universe of listed firms. Moving from market reactions to legal outcomes, sequential logit models of the litigation process show that U.S. and foreign defendants have similar probabilities of dismissal and settlement, conditional on being sued, but diverge sharply at trial: U.S. corporate defendants are substantially more likely to win at trial than observationally similar foreign firms. In a representative product-liability case in 2000, the model predicts a roughly 78% win rate for a U.S. defendant versus 63% for a foreign defendant. The disadvantage is more pronounced in certain regions, particularly Northeastern and Western districts, and is concentrated in judge-decided rather than jury-decided trials. Robustness checks using limited damages data, ADR status, and alternative case-mix controls do not support explanations based on higher stakes, weaker financial health, or collectability problems for foreign firms. Cross-listed foreign companies (ADRs) do not enjoy better outcomes or milder market penalties than non-ADR foreign firms. Taken together, the authors interpret the consistent outcome differences, combined with rational market anticipation of those differences, as evidence of a measurable home court advantage for U.S. corporations in federal corporate litigation.

Summary

This article investigates whether U.S. corporations benefit from a measurable home court advantage over foreign corporations when sued in U.S. federal courts. The authors assemble a large litigation dataset of over 3,000 corporate lawsuits filed between 1995 and 2000 across antitrust, contract, employment, patent, and product liability claims, identifying which defendants are U.S. versus foreign public companies. They link these cases to detailed stock-return and accounting data, then compare the market’s reaction to lawsuit filings with the subsequent path of the cases through dismissal, settlement, and trial.

The first part of the analysis uses classic event-study techniques to measure abnormal stock returns around the filing date. While litigation announcements predictably depress share prices for all defendants, the magnitude of the market penalty is significantly larger for foreign firms. Even after controlling for firm size, leverage, profitability, industry, year, and case type, foreign defendants experience markedly greater value losses. To rule out the possibility that only especially serious or high-stakes cases are brought against foreign firms, the authors estimate a Heckman selection model using a universe of tens of thousands of non-sued U.S. and foreign firms. The selection-corrected results confirm that investors rationally anticipate that foreign corporations face worse litigation prospects than their U.S. counterparts.

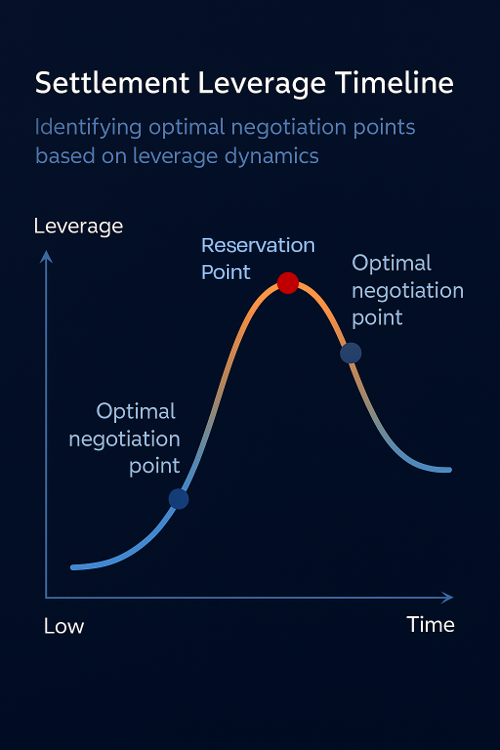

The second part tracks how cases progress through the litigation pipeline. Using a sequential logit framework, the authors model the probability of dismissal, settlement, and ultimately win or loss at trial, again correcting for non-random selection into being sued and into trial. They find that U.S. and foreign firms have essentially similar dismissal and settlement probabilities. The critical divergence appears at the trial stage: conditional on reaching trial, U.S. corporate defendants win significantly more often than similarly situated foreign defendants. In a stylized product-liability dispute circa 2000, the model implies a roughly three-quarters probability of winning for a U.S. firm versus only about two-thirds for a foreign firm, a difference that is both statistically and economically important.

The authors then explore alternative explanations for this pattern. They examine limited data on damages and firm financials and find no systematic evidence that cases against foreign firms involve higher stakes or that foreign defendants are less solvent or less collectible. They also compare foreign firms with and without U.S. cross-listings (ADRs) and observe no meaningful improvement in either market reactions or trial outcomes for cross-listed firms, undermining the idea that deeper integration into U.S. markets equalizes courtroom treatment. Finally, they disaggregate results by region and decision-maker, showing that the foreign-defendant disadvantage is concentrated in some regions, especially the Northeast and West, and is more pronounced in cases decided by judges rather than juries.

Taken together, these findings suggest that nationality is a consequential factor in U.S. federal corporate litigation. Markets correctly anticipate that foreign corporations face steeper odds at trial, and this expectation is borne out empirically even after extensive controls for case type, jurisdiction, firm characteristics, and selection effects. For practitioners and corporate counsel, this implies that forum selection, removal or transfer motions, and the choice between settlement and trial should explicitly account for nontrivial, statistically documented differences in how domestic and foreign firms fare before U.S. federal judges. More broadly, the article demonstrates that judicial behavior and litigation outcomes are structured in ways that can be measured and incorporated into litigation risk assessments, revealing a concrete home-court advantage for U.S. firms.

How the Study Advances Empirical Understanding of Legal Outcomes

The study finds that legal outcomes in U.S. federal corporate litigation exhibit structured, repeatable patterns that are systematically associated with institutional features of the litigation process rather than with random variation across cases. By tracking how cases move from filing through dismissal, settlement, and trial, the analysis shows that outcome disparities emerge at specific procedural stages, demonstrating that the litigation pipeline itself shapes results in measurable ways. By using large-scale court records, market data, and econometric modeling to isolate these patterns, the study reflects an empirical, case-based approach to understanding legal decision environments, consistent with Pre/Dicta’s emphasis on rigorous analysis as a necessary component of high-level strategic litigation practice.